QuickBooks Payroll Not Taking Out Taxes

Tax services, Accounting Services?

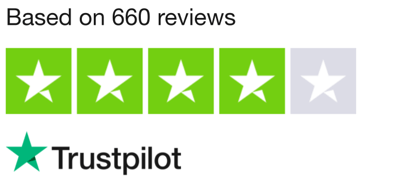

You Focus On Your Business, We Will Do Your Books. Independent QuickBooks Setup Services. We are one of the Best Advanced QuickBooks ProAdvisors in US

Monthly Accounting, BookKeeping Solution or One time help for Entrepreneurs and Small Businesses using Quickbooks and Sage Users

Connect with Pro Advisors, for all things Quickbooks

- Quickbooks Payroll Issue

- Quickbooks Error

- QuickBooks Accounting

- QuickBooks Accounting

At Right Books, we feel your time is important and worth a smooth accounting process. As a small business owner/executive or an accounting professional, you know how critical accuracy/efficiency is in handling finances. One thing I can say for sure is that QuickBooks has definitely simplified the payroll processes. Having come across these problems, though, such as QuickBooks Payroll not calculating taxes at all, can be truly painful and also disruptive.

In this detailed guide, we will explain the main reasons for QuickBooks Payroll Not Taking Out Taxes and show you how to get rid of such an issue. Whether you have been using QuickBooks for a long time or are just getting familiar with it, you’ll definitely get useful points to overcome this obstacle.

What is QB Payroll Not Taking Out Taxes Issue?

Before fixing the issue, you must understand why QuickBooks payroll cannot deduct the correct taxes from salaries.

- Incorrect Payroll Setup: The number one source of tax computation mistakes is the incorrect setup of payroll. It includes inaccurate reporting of employee data, tax setup, and payroll items.

- Outdated Software: The old QuickBooks software or tax rates may cause errors in the tax figures. Staying up to date on your software will make sure that the new tax regulations are complied with.

- Changes in Tax Rates: Tax rates may fluctuate from year to year, or even within the same year, as a result of legislative changes or by tax authorities that update. Not changing the tax rates in your QuickBooks could lead to calculating the wrong taxes.

- Data Entry Errors: Even a small mishap of entering wrong information for a worker in terms of wage and tax can hinder QuickBooks Payroll from calculating appropriate taxes properly.

- Tax Agency Updates: Sometimes, quick changes or random errors in the tax agency system can interrupt the QuickBooks payroll tax calculation. This happens quite commonly when there are changes in regulations or updates.

See Also: QuickBooks Desktop Crashing Issue

Troubleshooting Steps

Review Payroll Setup:

You need to review carefully your payroll setup before you go through troubleshooting with QuickBooks Payroll.

Double-check employee information: Begin with confirming that all employee information, like withholding allowances and filing status, is correct. These differences may lead to inaccuracies in tax calculation.

Verify tax setup: Finally, check the tax status of each employee. In regard to taxes, ensure the correct set-up of federal, state, and local taxes for every employee based on their location and tax filings.

Review payroll items: Set the time aside to go through your payroll documents, including the wages, deductions, and contributions. Make sure these are configured correctly and depict each employee’s compensation information accurately.

Update QuickBooks Software:

It is important to update the QuickBooks software frequently in order to have correct tax calculations.

- Check for updates: Startup QuickBooks and click on the update tab. Check for any available updates to both software and tax tables.

- Install updates: If updates are available, go ahead and install them as soon as possible. Among these updates are the application of the current tax rates and the calculations, thus maintaining a payroll system that follows the law.

Verify Tax Rates:

Tax rates do change sometimes; thus, you need to ensure that the most recent rates are utilized in QuickBooks.

- Cross-reference tax rates: Check whether the tax rates in QuickBooks are the same as the ones provided by tax authorities. This means that in your tax calculations, you’ll be using exact rates.

- Update tax rates manually: As an option, check the change in the tax rates in QuickBooks and update them according to any new rates that have come up. This step becomes the most critical one if you have software old-fashioned or current tax tables version.

Double-Check Data Entry:

Keying errors can make account problems very complicated.

- Review employee wage and tax information: Comprehensively look through in QuickBooks the wages and taxes in view of each worker. Consider a division for any errors and unfit data that could mislead the tax calculation.

- Correct errors: If you notice any discrepancies in data entry, kindly correct them right away to prevent any errors from being inputted into the system.

Contact Support:

- Reach out to QuickBooks support: Calling QuickBooks support will help you with resolving the issue. Be specific about your issue and the actions you have taken to try to stop the issue from occurring.

- Provide detailed information: Apart from that, ensure you give as much detail as you can in supplying the agents with the problem. This consists of any error messages you ever faced as well as the specific situations you missed calculation or deduction of taxes. Besides, you need to again stress the steps of troubleshooting you have already tried.

Check Payroll Item Mapping:

- Payroll item mapping is a process of the attribution of the payroll items (wages, taxation, and deductions) to the proper accounts in your chart of accounts.

- Select the Payroll Items List from QuickBooks and look over the mapping for each payroll item.

- Make sure that every item is being plotted into the proper income, expense, or liability account.

- Having the wrong mapping is likely to lead to a situation where no taxes will either be removed from a paycheck or deposited properly.

The negligence on the part of QuickBooks Payroll Not Taking Out Taxes from your paycheck can be very annoying, but with the correct approach, you can achieve an effortless solution in no time. By identifying the possible culprits, going through payroll setup practices, updating software, verifying tax rates, and checking the accuracy of the data, you can resolve the challenge with confidence.

At Right Books, we grasp the significance of generating an error-free payroll for your business. We care about your success. That’s why we pledge to deliver the required tools and assistance to assist you in overcoming the difficulties and simplifying the accounting processes. Do not forget that we and our team are always ready to help you in the event of problems.