Pay Payroll Taxes in QuickBooks Online

Tax services, Accounting Services?

You Focus On Your Business, We Will Do Your Books. Independent QuickBooks Setup Services. We are one of the Best Advanced QuickBooks ProAdvisors in US

Monthly Accounting, BookKeeping Solution or One time help for Entrepreneurs and Small Businesses using Quickbooks and Sage Users

Connect with Pro Advisors, for all things Quickbooks

- Quickbooks Payroll Issue

- Quickbooks Error

- QuickBooks Accounting

- QuickBooks Accounting

Introducing Right Books, your go-to resource for leveraging QuickBooks Online to navigate the complex world of payroll taxes. Effective payroll tax management is essential for your company’s financial stability and regulatory compliance in today’s fast-paced business environment. We will lead you through the nuances of Pay Payroll Taxes in QuickBooks Online, a robust platform that streamlines the process. This extensive guide will help you make the most out of this adaptable tool.

Comprehending QuickBooks Online Payroll Taxes

Before delving into payment specifics, it’s crucial to have a firm grasp of payroll taxes and how they affect your company. QuickBooks Online offers an intuitive UI for handling your business’s financial operations, including payroll taxes. Federal, state, Social Security, Medicare, and unemployment taxes are examples of payroll taxes.

Federal Income Tax: This tax is deducted from workers’ paychecks to finance government initiatives. State Income Tax: Based on state laws, state income tax is comparable to federal income tax—Medicare and Social Security taxes: Funds allocated to the social security and healthcare systems. Federal and state payments to unemployment programs are known as unemployment taxes.

Comprehending these elements is essential for precise tax computations and adherence. QuickBooks Online simplifies this procedure by automating computations based on the most recent tax laws and rates.

Using QuickBooks Online to Set Up Payroll Taxes

Now that we understand the fundamentals, let’s move on to the valuable procedures for configuring payroll taxes in QuickBooks Online.

Step 1: Check Your Payroll Tax Configuration

Verify the accuracy of your company’s payroll tax settings in QuickBooks Online. Verifying your company’s details, tax identification numbers and personnel data falls under this category. At this point, a comprehensive evaluation establishes the framework for effective payroll tax management.

Step 2: Configure Payroll Items

Payroll items in QuickBooks Online can be customized to meet your company’s needs. Wages, taxes, and deductions are a few examples of these items. Accurately configuring these components guarantees that the system calculates payroll taxes appropriately.

Step 3: Automated Payroll Tax Calculation

Use QuickBooks Online’s automated features to ensure precise payroll tax calculations. Error risk is decreased by the system’s consideration of tax rates, employee pay, and other pertinent variables. This automated procedure reduces the chance of calculation errors while also saving time.

Payroll Tax Payment With QuickBooks Online

Now that your payroll taxes have been computed correctly, it’s time to learn how to Pay Payroll Taxes in QuickBooks Online

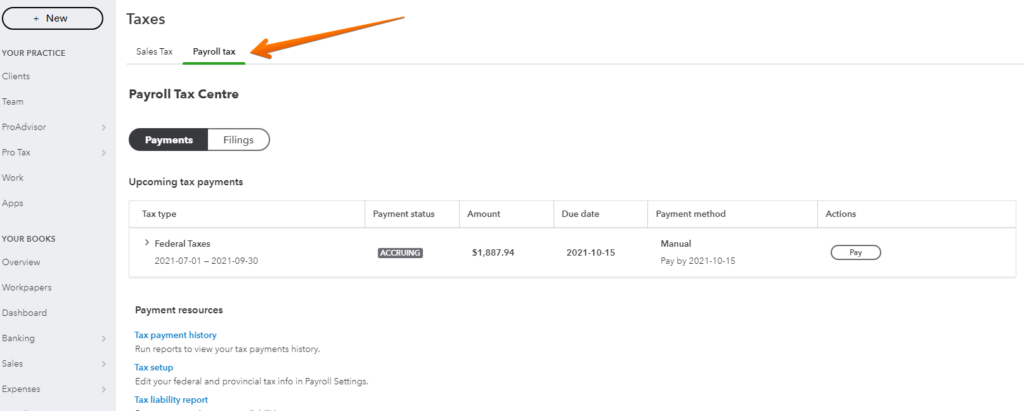

Step 1: Go to the Payroll Center:

Navigate to QuickBooks Online’s Payroll Center. You can handle every facet of payroll, including tax payments, from this unified portal. It’s simple to keep track of and manage your tax obligations with the help of the Payroll Center, which offers a thorough overview of your payroll activities.

Step 2: Examine Payroll Debts:

Verify the accuracy of your payroll liabilities before making any payments. Comprehensive reports on taxes due and approaching payment deadlines are available through QuickBooks Online. To stay in compliance and avoid fines, you must take this action.

Step 3: Start Making Tax Payments:

Decide which taxes you wish to pay and how you want to pay them. Payment methods supported by QuickBooks Online include paper checks and electronic financial transfers (EFT). Thanks to its versatility, you can select the payment method that best suits your business needs.

Step 4: Keep Track of the Payment:

Once the payment has been made, enter the transaction details in QuickBooks Online. By doing this, you may make sure that your financial records appropriately represent the taxes you have paid. Maintaining accurate records is crucial for both financial transparency and readiness for audits.

Solutions and Advice

Problems can still occur even with QuickBooks Online’s intuitive interface. Discuss typical issues and advice for a seamless payroll tax payment procedure.

Common Problems:

- Inaccurate tax computations: Make sure your payroll items are set up correctly to prevent errors in computations.

- Payment disparities: Regularly balance your payroll transactions to find and fix any disparities.

- Mistakes in filing: Verify your tax returns again to avoid any problems with compliance.

Pointers for Easy Processing:

- Update employee data and tax rates regularly: Remain aware of adjustments to tax rates and swiftly update employee data.

- Set up automated tax deadline reminders: Use the QuickBooks Online reminder tools to remember crucial tax dates.

- Use QuickBooks Online’s help resources: Use QuickBooks Online’s support options, such as customer service and help articles, to resolve any issues quickly.

Staying Compliant and Secure

For any firm, ensuring compliance with tax legislation is crucial. You can improve your security and compliance efforts using the tools and services that QuickBooks Online provides.

- Updates Automatically:

The automated updates in QuickBooks Online help you stay up to current on changes to tax regulations. The platform lowers the chance of non-compliance by adjusting to the most recent regulatory standards. To take advantage of these improvements, make sure your system is running the most recent version and periodically check for updates.

- Measures for Data Security:

Use QuickBooks Online’s strong security safeguards to safeguard confidential employee and financial data. Make sure two-factor authentication is in place, change passwords on a regular basis, and only allow authorized workers access. QuickBooks Online protects your data using encryption and secure connections, giving you confidence in the integrity and privacy of your financial data.

Any business owner or financial manager should become proficient in Pay Payroll Taxes in QuickBooks Online. Right Books is dedicated to assisting you in confidently navigating this complex procedure. Through thoroughly comprehending payroll tax principles, precise setup, and utilizing QuickBooks Online’s robust functionalities, you may optimize your payroll tax administration and concentrate on your primary responsibility—expanding your enterprise.

Ask for expert help!

Coming towards the end of this post, we hope that the information provided above will prove helpful in resolving the . If the error persists or if you encounter challenges while applying the suggested fixes, it’s advisable not to spend too much time attempting further solutions. Data damage problems can be sensitive, and attempting trial-and-error methods might lead to severe data loss.

Feel welcome to reach out to our professionals at Number. Our QuickBooks error support team is available 24/7 to assist you in resolving the issue without causing additional complications.

3 thoughts on “Pay Payroll Taxes in QuickBooks Online”

How to Install or Uninstall the Plugins in QuickBooks - Rightbooksllc

[…] in today’s fast-paced business environment. We will lead you through the nuances of Pay Payroll Taxes in QuickBooks Online, a robust platform that streamlines the process. This extensive guide will help you make the most […]

Fixing QuickBooks Error 15311: Simple Solutions for Hassle-Free Finances

[…] in today’s fast-paced business environment. We will lead you through the nuances of Pay Payroll Taxes in QuickBooks Online, a robust platform that streamlines the process. This extensive guide will help you make the most […]

Change Registered Email Address in QuickBooks

[…] See Also: Pay Payroll Taxes in QuickBooks Online […]